Firing up towards early retirement

What is the FIRE movement?

Retirement involves permanently exiting the workforce and relying on a mix of superannuation, savings, and other investments for income. If you aim to hang up the work boots early through the FIRE movement, you should focus on two key concepts: your FIRE number and the 4% rule.

Your FIRE number is typically calculated by multiplying your annual expenses by 25, providing an estimate of the amount you’ll need for a comfortable early retirement. The 4% rule suggests that, once you’ve saved this amount, you should aim to withdraw 4% annually during retirement. This approach allows most retirees to maintain their lifestyle and stretch their savings over a 30-year period. For example, if you spend $60,000 annually, your FIRE number would be $1.5 million (25X $60,000), the target amount needed to retire comfortably. Check out our savings plan calculator to work out how much you could save over a period of time.

Different FIRE strategies for achieving financial freedom

Supporters of the FIRE movement may use different strategies to fulfil their savings goals, but achieving high levels of savings will require large dollops of commitment and sacrifice. There’s no one-size-fits-all solution for your post-work life – and even the most carefully planned approaches to your retirement come with uncertainties. For example, it’s impossible to predict factors such as life expectancy, medical requirements, or unforeseen expenses in retirement.

Some people aim to save 50% to 75% of their wage or salary annually and live relatively frugally for many years. It’s also important to remember that retirement needs may change over time due to shifts in salaries and careers, while family circumstances, including having more mouths to feed, can require regular reviews of your retirement strategy.

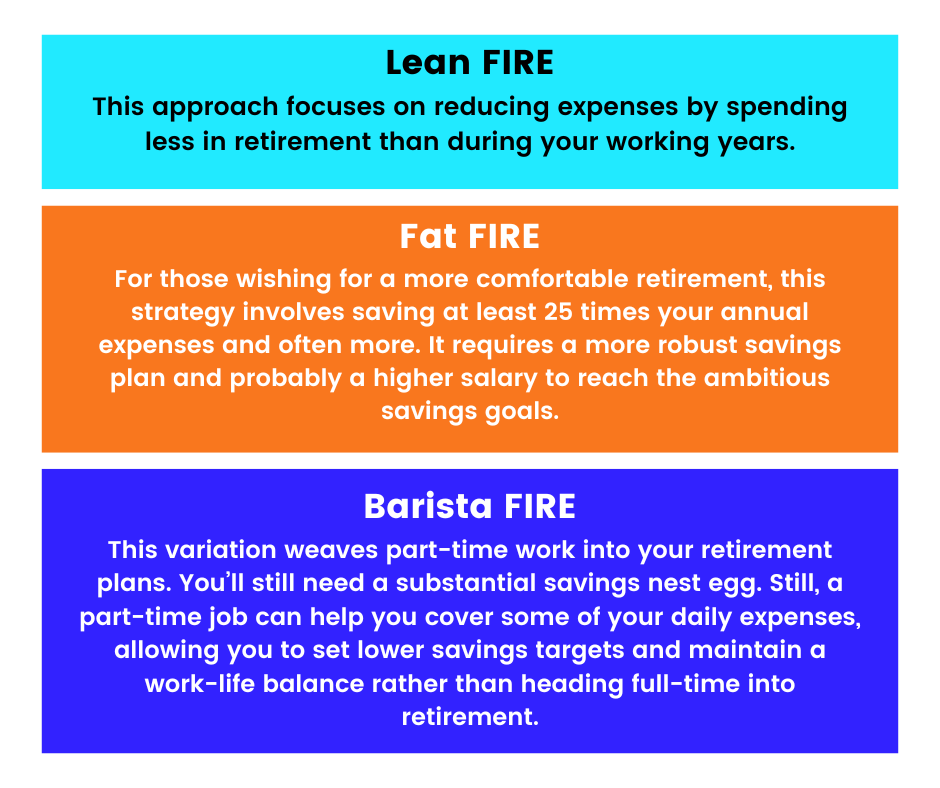

Furthermore, there are different versions of FIRE to match your financial circumstances and retirement needs. Here are three prominent variations:

What are the pros and cons of the FIRE movement?

Before committing to an early retirement through the FIRE movement, it’s worth weighing up its potential impact on your life.

Some people love their businesses or jobs. However, even those who enjoy working may experience improved mental health by stepping away either full or part-time from the workforce early. Another advantage is the increased freedom to spend more time with family and friends or pursue hobbies or passions whether it be playing sports, learning new skills, taking on more travel, or volunteering. Additionally, the discipline of FIRE helps build a substantial savings safety net and even if investments don’t perform as expected down the track, a strong financial foundation is put in place to help navigate stormier times.

Also, the strict saving and budgeting associated with FIRE retirement can be challenging for middle- and low-income earners. It can feel like you need to embrace an Ebenezer Scrooge mentality to hit your savings targets, and living on a tight budget can seem restrictive. Fortunately, Easy Street’s online savings accounts can make it easier to stash away some cash. With our accounts, you can allocate your savings into up to three different goals or buckets, such as paying off your mortgage faster, building a retirement nest egg or setting up an education fund for the kids—all within a single account.

One of the best ways to fire up your savings is by paying off the mortgage faster. However, you’ll first need to find some extra cash to put toward your debts. At this point, a budget comes in handy. Without a budget, the goal of paying off debt faster becomes much more complicated. If you’re new to budgeting, Easy Street offers a free budget planner that can guide you through the process step by step.

Ultimately, the FIRE movement isn’t for everyone. Prospective FIREES should be prepared to make substantial financial sacrifices and understand that, like any investment strategy, there’s no guarantee of success. However, FIRE can work for those with discipline and commitment as a path to achieving early retirement.

To learn more about our suite of savings products to assist you towards an early retirement, call the Easy Street team on 1300 13 14 65.