Tips to help you reduce your debts

If your current level of debt is stopping you from doing some of the things you’d like, our tips can help you be on your way to reducing your debts faster.

Reducing your debts can make a big difference to your finances and your lifestyle. Having less debts can help you free up money to put towards other things, save you money by not paying interest, save more to help you get ahead, and improve your overall financial position.

Re-assess your budget

You should try to determine whether or not you can afford to pay extra off your debts by re-assessing your budget. If you’re serious about reducing your debts quickly, you may need to make a few sacrifices, even if it is only for 6 months. By working out how you spend your money, you can see where there may be opportunities to spend less on some things so you can use the money to pay off your debts instead.

You can use our free budget planner to help re-assess your budget.

Pay off your high interest debts first

High interest debts such as credit cards should be paid off first as these are the debts that are costing you the most money in interest. You should start by checking the current interest rate you are paying on all your current debts and identifying which debts you should prioritise. If you have a high interest debt that you may not be able to pay off quickly, consider refinancing it to a loan with a lower interest rate to save money on interest.

Make extra and lump sum payments on your loans

The fastest way to get rid of those unwanted debts is to make as many additional repayments you can. This could mean increasing your regular repayment amount, and/or making lump sum payments off the loan from things such as gifts and tax returns you may receive.

Refinance your loan

If you’re not paying off your credit card balance in full each month, you could be paying as much as 20%p.a. interest on the outstanding balance. If you either can’t afford to pay off your credit card balance in full each month, or just struggle to get around to it, you should consider doing a balance transfer to a lower rate while you pay off the card. This will save you money in interest repayments. As soon as it is paid off, you can cancel the card, thus reducing your overall debt.

Consolidate your debts

Debt consolidation involves taking out one loan to pay out others. By rolling a number of debts you may have in to one single loan with one repayment, it can make it easier to manage your debts. If you have multiple loans you are juggling, debt consolidation can also save you money as you could pay less interest overall, while having the certainty of knowing that your loan repayments won’t change if you fix your rate.

What about your home loan?

Getting rid of your extra debts such as credit cards, store cards and personal loans is important, but don’t forget about your home loan. Your home loan is the debt you could potentially save the most money on.

Make additional repayments

Making additional repayments beyond what’s required in your minimum monthly repayment is one of the best ways to reduce the total interest paid and term of your loan. As a rule of thumb, every $1 in extra repayments you make early in the life of your loan saves around $2 in interest over the term of the loan, depending on the level of interest rates.

Make lump sum payments

Paying fortnightly instead of monthly will also take thousands off in interest over the life of your home loan. Why? Because there’s two extra repayments in a year when you pay fortnightly (26 times) than monthly (24 times, if split in half).

Make fortnightly payments

Paying fortnightly instead of monthly will also take thousands off in interest over the life of your home loan. Why? Because there’s two extra repayments in a year when you pay fortnightly (26 times) than monthly (24 times, if split in half).

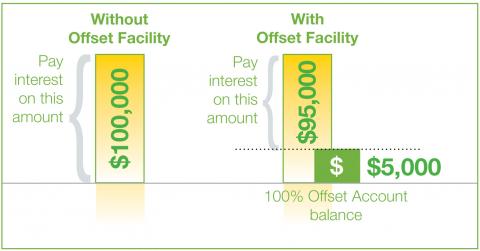

Use a 100% offset account

Another very effective way is to use a 100% Offset account. Simply deposit your salary into the 100% Offset account and any money in the 100% Offset account is deducted from your loan balance before interest is calculated. Therefore any extra money in your transaction account saves you interest on your loan, thus shortening the term of your loan.

For example, if you have a $100,000 home loan and $5,000 in your 100% Offset account, you would only pay interest on a notional balance of $95,000. That’s $5,000 you don’t have to pay interest on! A 100% Offset account with Easy Street is different. For a start we allow this account to be used with our fixed rate home loans, unlike many other lenders in Australia!

It is also free. There is no monthly loan service fee associated with keeping a 100% Offset account.

What to do once you’ve paid off your unwanted debts

Once the extra debt you wanted to be free of is gone, it’s time to reconsider your savings habits and focus on getting ahead. Most of us approach our finances from a “spending” mentality. Whether paid weekly, fortnightly or monthly, we pay our bills and prioritise lifestyle expenses before seeing what’s left (if anything) for savings.

The first bill you pay should be to yourself – into your savings. Whether your goal is to save $400 a fortnight or $400 a month, do that first before you pay your bills. What’s left over after savings and bills is for your lifestyle. If saving is the final destination for your pay – after bills and lifestyle – you are likely to spend your entire income before putting any money aside. Start small and build up. Put aside an amount that you won’t miss. If you think you can save $500 a month, start with $200.

You’ll probably find after six months that you didn’t miss that money, and then you can increase the amount you save. Limit access to your savings account. Your savings can be quickly depleted if you have easy access to them. There will always be “some kind of emergency” to take money out at the ATM so put your savings into accounts which have limited access restrictions and conditions around them.

Last updated: 4 November 2021

The information contained in this article is only correct at the point of time of publication. It is general information and has been prepared without taking into account your personal circumstances, objectives or needs. Please consider if this information is right for you before making a decision to acquire any product.