Understanding 100% offset accounts

Reducing the time it takes to pay off your home loan takes more than just a low rate.

The features and benefits attached to the loan also play a very important role! Many Australians don’t fully understand how to use their home loan features to help pay off their loan sooner. One of the most effective ways to do this is by taking advantage of an offset account.

The term ‘offset account’ and how it works is not always well understood, so it can often get overlooked when comparing home loans. However, using a 100% offset account could save you thousands in interest which means it can help you pay your loan off sooner.

How does an offset account work?

A 100% offset account is an account linked to your home loan where you can park your savings and spare cash. You can even deposit your regular income to the account and just transfer out what you need to spend, as you need it, to maximise the balance in your offset.

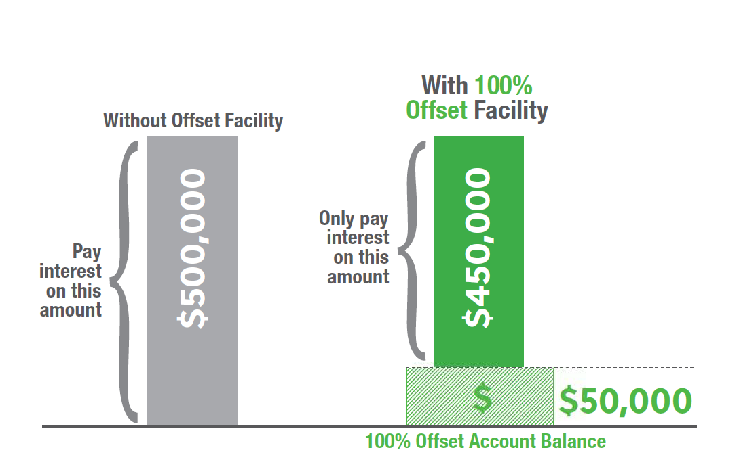

Then, when interest is calculated on your home loan, the balance in your offset account is deducted from the loan amount owing, and interest is only changed on what remains

For example: If you have a home loan of $500,000 with $50,000 in an offset account, you will only be charged interest on the remaining $450,000.

Here’s a simple infographic to explain how it works:

So how much can you save?

Considering how you use it, it is possible to make a real dent in your debt. It’s easiest to think of an offset account as simply an account where you can park your savings, except, the return is greater. For example, instead of earning say, 2.80%p.a. on your savings of $30,000 in a regular savings account, you could save 4.50%p.a. in interest on $30,000 of your home loan. (Assuming your home loan rate was 4.50%p.a.)

Get on Easy Street today

Generally offset accounts are most often attached to variable home loans. At Easy Street we offer a 100% offset facility on both our variable and fixed rate home loans. If you’d like to take advantage of a great value home loan that offers a 100% offset account, view our home loan range here.

All lending subject to lending guidelines. Terms and conditions, fees and charges apply – details available on application.

Last updated: 22 March 2024

The information contained in this article is only correct at the point of time of publication. It is general information and has been prepared without taking into account your personal circumstances, objectives or needs. Please consider if this information is right for you before making a decision to acquire any product.